CEO and MD Rohit Jawa | Photo credit: Ebenezer Stephen Duraappah B 10801@chennai

The high costs of inputs and moderate urban demand continued to maintain brakes in the consumer goods of rapid movement Bellwether Hindustan Unilever, which saw a fall in net gains in the fourth quarter of the growth of the weak underlying volume. The operational margin was also reduced and reduced margin forecast with higher planned investments in high growth demand spaces.

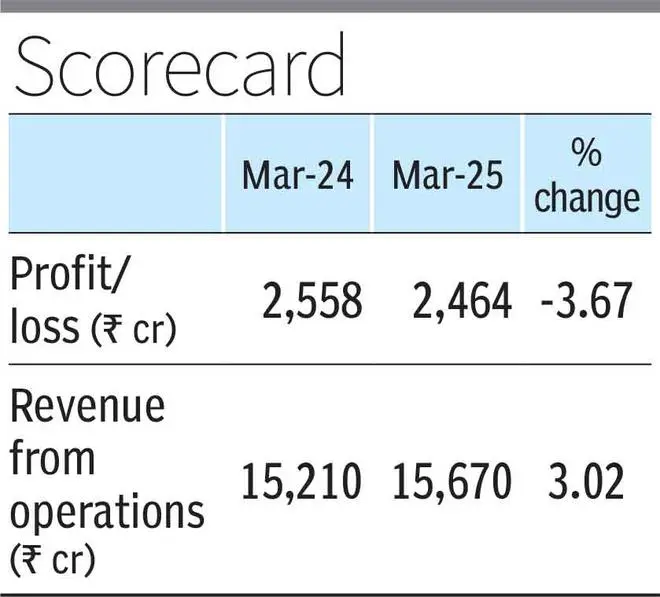

Hul’s net consolidated gain in the fourth quarter fell 3.67 percent to ₹ 2,464 million rupees and the revenues of operations increased 3 percent to ₹ 15,670 million rupees in the underlying volume growth or 2 percent. Its operational margin decreased 30 bp with 23.1 percent. In the period near median, the company has set the Ebitda margin at 22-23 percent of the previous estimate or 23-24 percent.

The company attributed the impact on the margins to the high costs of inputs in categories that include tea, coffee and skin cleaning.

“While palm oil prices and skill milk dust were deflation, tea saw an interannual inflation of 20 percent, and coffee remained high. Instead of completely passing the burden of the highest costs of raw materials for consumers, Hul opted for smaller and staggered price increases, which led to a price vs. incomparce cost that dentted seriously margin,” said the company.

In a media interaction, the CEO and MD Rohit Jawa said that the macro indicators for the economy, including the prognosis of a monsoon above normal, presaged a return to the demand for consumption. Later, in an analyst call, Jawa said that Unilever’s new CEO, Fernando Fernández, was optimistic about India, who is the beloved to build as one of the key markets as part of the general strategy of the Anglo-Holandes company. Fernández, who assumed the position of CEO of Unilever on March 1, sees India and the United States as anchor markets.

Final dividend

The Board of Directors exceeded a final dividend of RS 24 per action.

In the close to medium period, Hul hopes that growth gradually improves with the portfolio transformation actions and the best underlying macro conditions. “We anticipate that the first half of the FY26 is better than the second half or financial year 25. If the products remain where they are, we hope that the price growth is in the low range of a single digit,” he said.

Home attention, the largest income taxpayer, saw a high volume growth of a single digit, but other segments such as food, beauty and well -being and personal care sales were slow.

The recently acquired D2C brand minimalist from Hul registered a turnover or around ₹ 500 million rupees in fiscal year 2015.

Rural/ urban growth and investment

“We believe that this is the right time to accelerate investment, since we draw the future growth course of the company in the context of portfolio transformation actions and improving the macro environment,” Hul said in an informative session of the media.

FMCG specialty investments in the next quarters are in the antipatization of urban and rural buyers that increase their expenses with tax reimbursements, low interest rates and retreating food inflation.

“The rural markets have been essentially recovered and are resistant and robust in the last quarters. It is projected that the monzones will be decent again. Agricultural production is strong. The deposits are full. We believe that this will be an important trigger, given the company’s portfolio,” Jawa said.

While urban demand continued soft, Jawa said that macro triggers were positive, and food inflation had shown a strong fall. The fall in interest rates and tax relief for consumers were factors that would work well for consumption. “We believe this is a good time for us to lean and invest in growth.”

Premium trend

The company has seen a decrease in the trend of premiumization, the doors of the quarter of the quarter, but declared that premium products are growing strongly.

“Premiumization is yet to come. The premium segment is still ahead of the average market growth, but the distance has decreased in recent quarters. Small packages are growing faster. It is also directed by the fact that rural are OAS. And Lares. The categories are also growing,” Rohit said.

Fast trade

While the company said that fast trade and electronic commerce are growing rapidly, he pointed out that the general trade comprises 70 percent of its business.

“Quickcommerce remains a small part of our total business. General trade is the vast majority, that is the heart of our business. We are very focused on Kirana and distributed, inclusive in that model. More than two thirds of tea to general trade.

Posted on April 24, 2025