Nifty 50, Sesex and Nifty Bank’s indices emerged in the truncated negotiation last week. Nifty 50 and Sesex increased approximately 4.5 percent each. Nifty Bank’s index exceeded a strong 6.5 percent rally. The strong increase in the last two weeks indicates that Indian reference rates could be preparing for a reversal of trends and a new manifestation.

All sector rates closed green last week. The Realty BSE and the BSE Bankex increased more. They had 7.08 percent and 6.66 percent respectively.

Pattet of the investment table

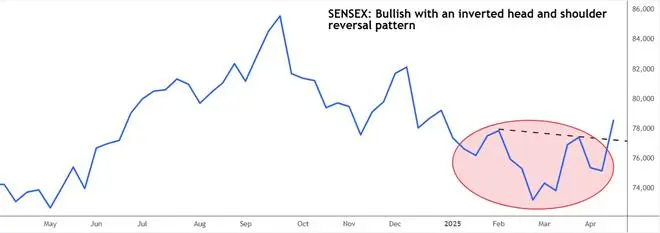

NIFTY and SENSEX are bullish with an inverted head and shoulder pattern in the daily line table. The ingenious bank index, on the other hand, made a bullish breakdown above a crucial resistance last week. In general, the graphics indicate that the long -term upward trend is beginning to resume.

We reiterate that any fall in next week will once again give the opportunity to enter the market from a long -term perspective.

Purchase of FPIS

Foreign portfolio investors bought Indian shares last week. The capital segment saw a net ticket of approximately $ 990 million. If the FPIs increase their quantum purchase, then it would help the Sensex and Nifty to increase even more in the next few days.

Video Credit: Businessline

Nifty 50 (23,851.65)

Nifty broke the crucial resistance by 23,200 and increased around 23,900 as expected. The index touched a maximum of 23,872.35 before closing the week with 23,851.65, an increase of 4.48 percent.

Short -term view: A crucial resistance is found in the region of 23,950-24000. If this resistance remains in its first test, a backward movement is possible at 23,400 or 23,300-23,200. However, a fall more than 23,200 is less likely, since new buyers can enter the market and limit the disadvantage.

We hope that the ingenious will remain above 23,300 in itself and violate 24,000 possible. Such a break can take the NIFTY to 24,400-24,500 initially. An additional rupture above 24,500 will clear the way for the NIFTY to sign up 24,850-25,000 in the short term.

The short -term view will become negative only if the ingenuity decreases below 23,200. If that happens, a drop at 22,700 can be soe. However, such a fall seems unlikely.

Graphic Source: TrainingView

Medium term view: Our long -term upward vision remains intact. We reiterate that a break of over 24,000 can lead to the NIFTY to 25,000-26,000 initially. It will also strengthen the upward case for the NIFTY to aim at 28,000-28,500 for this year or early next year.

The upward perspective will refuse only if the ingenious decreases below 21,650 which seems unlikely now. In the case of 24,000 limits for now, the wide range of 21,650-24000 can remain intact for a longer time.

Nifty Bank (54,290.20)

The Nifty Bank index broke above 52,000 as expected. The index increased and in fact has increased far beyond our expected level of 54,000. It reached a maximum of 54,407.20 on Friday and closed the week with 54,290.20, 6.45 percent more.

Short -term view: The bullish rupture above 53,000 and a decisive weekly closure indicate that the impulse is strong. The region between 53,000 and 52,500 will now act as strong support and limit the disadvantage. There is no great resistance ahead. A break above 54,500 will see the Nifty Bank index aimed at 58,000-58,500 in the short term.

The index has to fall below 52,500 to delay the aforementioned rally. In that case, you can see a drop at 51,500-51,400. For this fall to happen, the Nifty Bank index has to fail in its attempt to violate 54,500 immediately.

However, we do not expect a break below 52,500. In the event that the index does not break 54,500, it can be consolidated in a lateral range of 52,500-54,500 for some time. From then on, the bullish rupture can happen above 54,500.

Graphic Source: TrainingView

Medium term view: Our broader upward vision remains intact. In fact, the rise above 52,500 last week confirms the same. Our previous mentioned objective or 58,000-58,500 seems likely to be much faster than expected. From a long -term perspective, this rally leg has the potential to carry the Nifty Bank index to 61,000.

Sensex (78,553.20)

It emerged breaking over 77,500 last week as expected. The index touched a maximum of 78,616.77 and closed the week at 78,553.20, an increase of 4.52 percent.

Short -term view: Immediate resistance are 78,750 and 79,100. Sesex can violate 79,100, which can increase the bullish impulse. Such rest can take the Sensex to 82000-82,300 in the short term.

If Sensex does not breach 79,100, a corrective fall at 77,400 or 77,200 is a possibility. A fall beyond 77,200 seems less likely.

Graphic Source: TrainingView

Medium term view: We retain our broader bullish vision. As mentioned last week, the rest greater than 79,100 will strengthen the upward case. It will take the index to 85,000-86,000 initially. A possible break above 86,000 will see the Sensex aimed at 90,000 and only 92,000 in the next three quarters.

We emphasize that 70,800 is crucial support. Sensex has to reject below this level to become bassist. That seems unlikely now.

Dow Jones (39,142.24)

The first level of resistance of 40,800 mentioned last week has limited the rise in the Dow Jones industrial average. The index rose to a maximum of 40,791.18 and invested lower returning all profits. The Dow Jones has closed the week at 39,142.24, 2.66 percent lower.

Graphic Source: TrainingView

Perspective: The view is still low. The resistance is at 39,650, which can be the advantage from here. The IMEDIATED SUPPORT is 38,870. The Dow Jones seems vulnerable to break this support and return to 38,200-38,000 again.

In general terms, we hope that the Down would oscillate in a range or 38,000-41000 for a few weeks.

The index will have more sales pressure if it decreases below 38,000. If that happens, the Down can fall to 36,500-36,200.

Posted on April 19, 2025