The priority sector refers to sectors that have a significant impact on large sections of the population, the weakest sections and labor industries intensive in labor

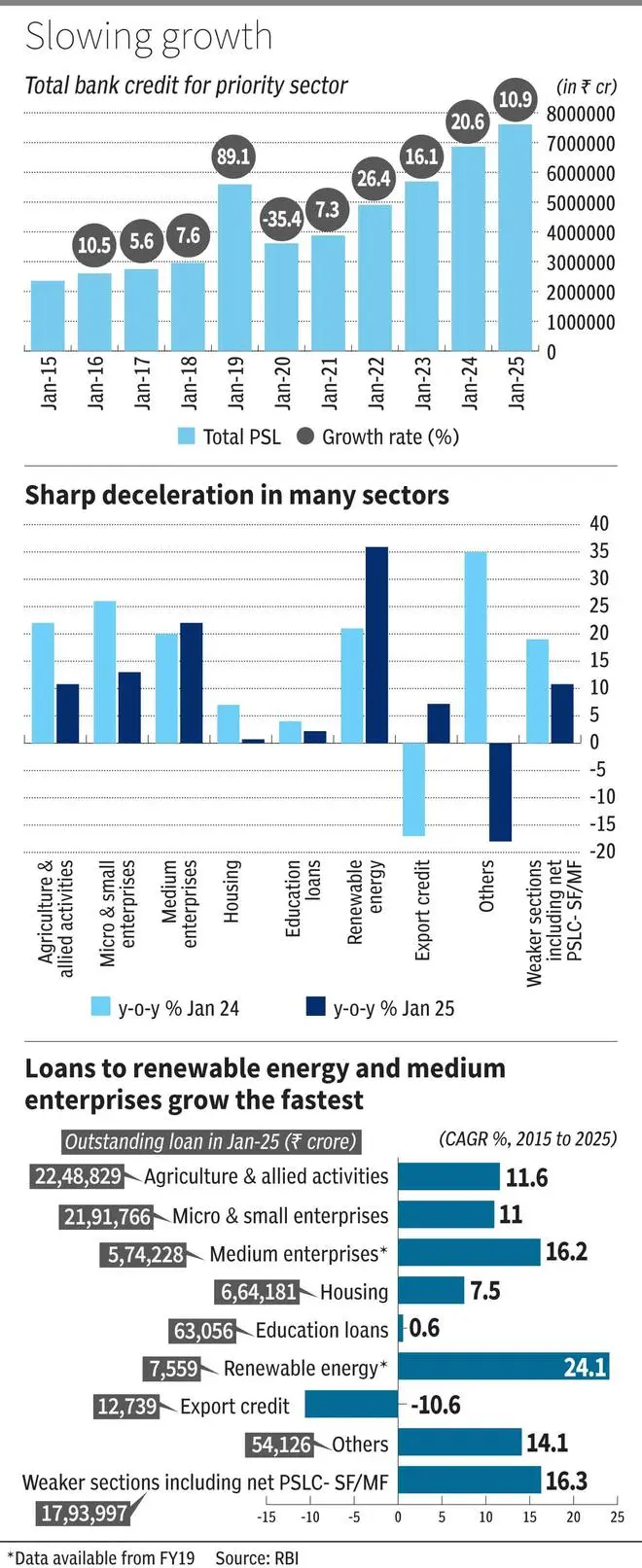

As the growth of general credit in economic skates due to regulatory adjustment and high interest rates, loans in the priority sector are also witnessing a deceleration. Total loans to the priority sector were located in ₹ 76.1 Lakh Crore from January 2025 compared to ₹ 68.8 Lakh Crore in January 2024.

The year -on -year growth (interannual) recorded in these loans was 10.87 percent in January 2025. This is half Yoy’s growth in January 2024 with 20.55 percent. This is a strong moderation compared to the year -on -year growth of 26.42 percent and 16.07 percent registered in January 2022 and January 2021 respectively. It is also the first time since the FY21 that the growth of PSL has fallen below 11 percent.

According to the RBI, the priority sector refers to sectors that have a significant impact on the large sections of the population, the weakest sections and the industries intensive in labor. The RBI requires commercial banks scheduled to assign a certain percentage of their credit to these sectors, since they are likely to be overlooked by traditional loan practices. The priority sectors include agriculture, mipyme, education, housing, social infrastructure, renewable energy and others.

“The recent deceleration in PSL credit growth can be attributed to high interest rates in segments sensitive to interest rates within the priority sector. In addition, banks and NBFC have adopted an extension of more cautious loan bush, participulates participating within the segments of MSME and small lenders.

Housing and social infrastructure.

The sectors that are witnesses of the highest loans in the loans of the priority sector are the agricultural, micro and small and medium enterprises industries. The outstanding loans in these segments were located in ₹ 22.5 Lakh Crore, ₹ 21.91 Lakh Crore and ₹ 5.7 Lakh Crore, respectively, January axis, 2025.

Although Yoy’s growth was beaten in all sectors, loans to medium -sized companies showed resilience, registering a growth of 22 percent of Yoy in January 2025. Loans to the renewable energy sector were also witnessed by a strong increase or 35.9 percent in the same period.

However, housing loans recorded a strong deceleration, falling from a growth of 7 percent to only 0.7 percent, which raises questions about the impulse of government schemes such as Pradhan Mantri Awas Yojana (PMAY). According to Bisht, higher interest rates and limitations such as limited availability of affordable homes have played a role in resting training in the housing sector.

Loans to the social infrastructure sector slowed too much from 3 percent in January 2024 to -61.9 percent in January 2025.

Long -term trend

Despite short -term fall, long -term growth in PSL seems to be quite stable. The compound annual growth rate (CAGR) of agriculture and the MSE in the last decade has a constant range between 10 and 12 percent.

On the other hand, renewable energy and medium -sized companies have demonstrated robust growth in the last five years. The data presented by RBI reveals that loans to the renewable energy sector registered the highest annual compound or 24.06 percent annual (CAGR) rate in the last five years. Medium -sized companies followed closely with a CAG or 16.23 percent, which reflects a greater credit support for expanding companies. “This change is driven by winds, technological innovations and evolutionary credit risk dynamics … As the quality problems of assets in the traditional PSL sectors persist, banks are turning to sectors that offer areas of key more tight approach in FAVA in PSL portfolios,” Bisht added.

It is expected that the recent review of PSL guidelines, as of April 2025, which imposes more inclusive loans with their emphasis on housing, educational loans and equitable access to Waker’s finance sections to Waker help growth in the future

Posted on April 21, 2025