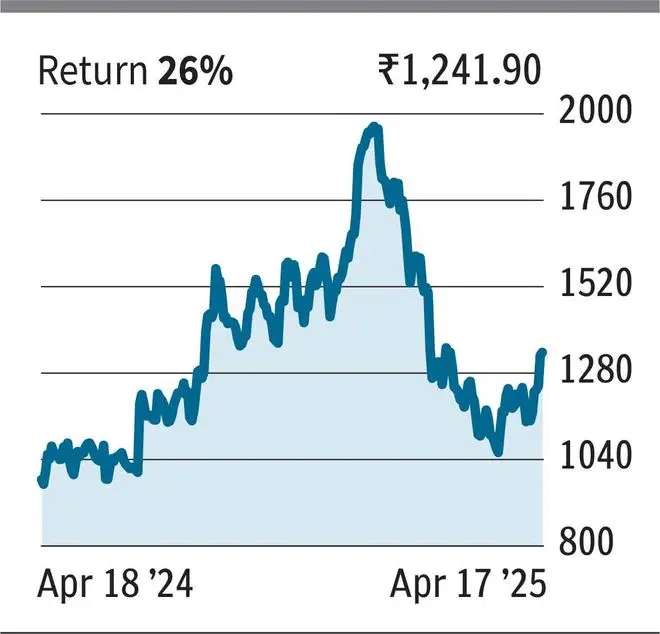

CDSL (₹ 1,241.90)

On a strong base

Central Depostory Services (India) Limited (CDSL) shares have won for two weeks in a row. The script that saw a strong drop in the price between December and March. But the bassist trend was arrested for ₹ 1,060. The recently bounced of this level confirms that ₹ 1,060 has been established as a good base.

In addition, a long -term trend line coincides at this level, so it is a crucial support. Participants can buy CDSL A ₹ 1,240 shares and buy more shares at ₹ 1,140. Place detention arrest in ₹ 1,000. When the price recovers ₹ 1,360, check the stop-to ₹ 1,200. When the action reaches ₹ 1,700, move the fou more stop-loss to ₹ 1,600. Liquide the lengths to ₹ 1,900.

Eternal (₹ 231.75)

Signs of a rally

The Eternal stock has been in a bearish trend since December last year. But in February, the bears lost traction. Althegh, the action was consolidating with a bearish bias, managed to maintain support in ₹ 200. earlier this month, the action recovered from ₹ 200. Last week, he violated a resistance of the trend line in ₹ 225 and the price is now above the mobile averages of 20 and 50 days.

The perspective seems to have become positive when the price can increase to ₹ 290. Therefore, one may consider buying the actions of Eternal to ₹ 230. Buy more shares if the price is submerged to ₹ 215. Place a stop -los a ₹ 195. When the price moves until ₹ 260, check the stop at the loss of 240.

State Bank of India (₹ 797.10)

Confirm an inverted head and shoulder

The actions of the State Bank of India (SBI) have been appreciating since the beginning of March. The recovery began in the back of the support in ₹ 680. Last week, SBI left a resistance to ₹ 785, which also turned out to be the neckline of an inverted pattern with a head and shoulder. Therefore, the trend seems to have been reversed and, according to the configuration of this table, the price can increase to ₹ 885 in the short term.

Keep in mind that the price band of ₹ 885-900 is a resistance. Merchants can reach SBI shares to ₹ 795 and accumulate if the price goes to ₹ 775. Place the fall in detention in ₹ 750. When the price reaches ₹ 840, increase the stop -los to ₹ 800. In a rally to ₹ 860, tighten the Stop -los to 835. Libere in ₹ 885.

Posted on April 19, 2025