President Trump’s China rate threatens Christmas.

Toy manufacturers, children’s stores and specialized retailers are stopping orders for winter holidays, since import taxes are marked through supply chains. Factories in China produce almost 80 percent of all toys and 90 percent of Christmas products sold in the United States.

The production of toys, Christmas trees and decorations is usually in full swing. Four to five months are needed to manufacture, pack and send products to the United States.

Trump’s 145 percent rates have caused a drastic marking in costs for US companies. Most entrepreneurs who have shared their plans with the New York Times have not yet canceled their orders. They expect the president to move away from the Brinkmanship tariff.

But the alarm in the industry is palpable, with colleagues who predict the shortage of products and high prices. Some business owners, citing how crucial are Christmas sales for their results, are consulting bankruptcy lawyers.

“We have a frozen supply chain that is putting Christmas at risk,” said Greg Ahearn, executive director of the toys association, a group of the US industry that represents 850 toy manufacturers. “If we do not start the production soon, there is a high probability of a shortage of toys this holiday season.”

For the United States Christmas industry, Chinese manufacture has no comparison with its speed and production capacity. Toy manufacturers review large portions of their product lines every year to adapt to the changing preferences of children. From materials to machinery, China’s factories are unique stores for importers.

Kara Dyer, founder of Storytime Toys, a manufacturer or books for children with game puzzles, usually makes a great holiday order with her Chinese factory in the first two weeks of April to have enough in mid -July. Christmas holidays represent approximately two thirds of their annual income.

Mrs. Dyer made a small order of products worth $ 30000 before the last rates, without waiting for them to increase to such high levels. That shipment is a route to the United States. When he arrives, he said, wait must $ 45,000 in rates. The shipment will provide enough inventory to company for a few months, and said it would probably increase prices at least 20 percent to cover the costs of the rate. But she is waiting to make a great vacation purchase.

“I will have the hope of another two weeks that the tariffs will be eliminated and I can make the order,” he said. “But if not, I will have to put my business in rhythm. I will definitely not make an order if the tariffs are in force. It would not make any sense. “

In a toy association survey of 410 toys manufacturers with annual sales of less than $ 100 million, more than 60 percent said they had canceled orders, and about 50 percent said they would leave the business within the week.

In West Side Kids in New York City, the owner of the store, Jennifer Bergman, 58, worries that he does not have toys to sell at Christmas. And the toys that you can have in your hands could cost twice what they did last year, which would rinse your duration of sales the most important time of the year.

The toy companies are already marking the prices of 10 to 20 percent, said Mrs. Bergman, whose mother opened the store 43 years ago. She said she would try to buy as much as she could now, but that the shortage was already starting. He had made a great order of scooters to arrive during the summer. But the importer redirized the shipment to Canada because he did not want to pay the rate. They told him that he would only get a part of his order.

If the tariffs remain, Christmas will be like “something we have never experienced before,” Bergman said. People will be online to buy things that cost two or three times more than before, he said. His business was already under pressure from the competition by Amazon, but fears that the rates will deliver a final blow.

“I don’t think it’s in the business for Christmas,” said Bergman, who added that he was consulting a bankruptcy lawyer.

Nick Mowbray and his brother, Mat, founded Zuru Group in China, making a variety of “plastic” standards, accessories with water balloons and bubble guns sold in Walmart and Target. He said the retailers were not making holiday orders. Zuru has reduced its marketing budget for the holiday season in half, to $ 60 million, because it hopes to sell Fer products.

Mr. Mowbray, originally from New Zealand, said everything was in “a waiting pattern.” If tariffs remain in 145 percent, hope for consumers to increase around 50 to 100 percent.

“That will be unaffordable for many families,” he said.

Trump has reached in recent days a conciliatory tone towards China and tariffs, feeding some hope among business owners who can exempt industries that do not represent a threat of national security.

Mr. Ahearn of the Toy Association said he was in Washington last week to press for a postponement of 24 months, that companies could find ways to manufacture their products in the United States.

But even if Trump grants temporary relief imports, significant interruptions will occur as companies rush to fulfill orders. Shipping costs are expected to increase, similar to the duration of the frenzy, the Covid pandemic, when a shortage of shipping containers in some cases led to an increase of ten times in the load prices.

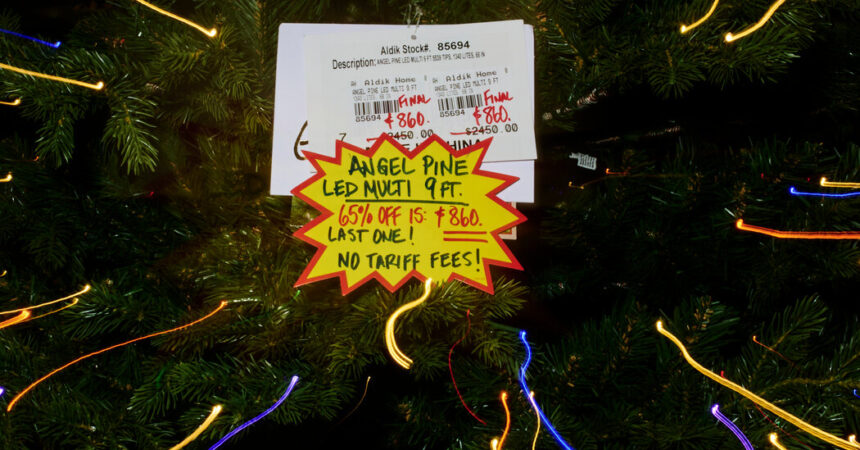

Christmas is the busiest time of the year for Aldik Home, a home articles store in Los Angeles. It generates more than two thirds of its annual sales in the last three months of the year, selling artificial Christmas trees, crowns, ornaments, lights and other decorations.

Larry Gold, the store owner, said he had worked with a Chinese factory for many years to design Christmas trees. Makes the order in January for shipping in June or July. This year, he planned to send 40 feet containers from China loaded with trees worth $ 600000. The current rate would require almost $ 1 million at a time.

“At this time, we have asked them to hold and wait,” said Gold, 72.

Last year, the store sold seven and a half trees for approximately $ 1,000. Gold said he would have no choice but to transmit the tariff cost to buyers, which would put the price of that same tree in more than $ 2,000. He said the price in force “would kill the product.”

“I can’t believe that no one in this country who is buying trees from China will pay the 145 percent tax, because they will never sell them,” Gold said.

At this rate, he said, he will not bring the trees, and his store, which has been open for decades, will have nothing to sell the most crucial period of the year. He said that he would like to be forced to close, costing his 40 employees.

“There is no Christmas industry here,” Gold said. “The whole product comes from China.”

Aaron Krolik New York contributed reports.