The Australians are looking at the barrel of some truly epic increases in housing prices, with the values of the properties that are predicted that they will double in many areas in just five years.

There will also be some areas that will go the other way, and housing values are expected to decrease in hundreds of thousands of dollars, according to a new real estate analysis.

The last proptrack modeling has revealed what prices of the properties would be in each city and suburbs by 2030 if the price growth trends of the last five years were repeated.

The data paint a terrifying image for possible housing buyers and emphasizes even more the need for a more affordable home.

As it is, a recently re -elected Labor Government continues to rely on its ambitious objective to build 1.2 million homes in mid -2029, even if some experts, including the Australian property council, predict that the nation could fall. Mass autumn is massive.

Regardless of the final result, the senior economist of Rea Group Angus Moore said housing buyers should expect a greater growth of prices in the coming years.

He said that the five -year modeling of protrack, although it was not a prognosis, illustrated some of the probabilities for the market, noting that past performance was not an indicator of the next price changes.

More news

Big Bank’s shock rates call property trusted peaks

Innovative planning laws approved to fix the aus housing crisis

How the work plan will affect you

Proptrack Angus Moore economist.

However, if prices continue as they have been, buyers could expect to pay around 61 percent for 2030 for a house in Sydney, 68 percent in Brisbane, 17 percent in Melbourne, 75 percent in Adelaida, 66 percent in Perth, 41 percent in Hobart, 30 percent in Darwin and 40 percent in Canberra.

“A couple of issues that really stand out are how strong have been the last five years, particularly for the markets once again affordable … particularly places in Western Australia, fragments of regional Queensland and … fragments of Adelaide, particularly northern Adelaide,” said Moore.

“For this year, we hope to see a kind of growth of a single low to medium digit in housing prices.

“We still hope that Adelaide does it relatively well (compared to other capitals). The growth of housing prices has slowed down, but, you know, they are still growing and the reasons why Adelaide exceeded Lewar’s note, a few years, the Bornars of Nesbe Nutwar, few notes of Bornar, the few borns Bornars Note, once.”

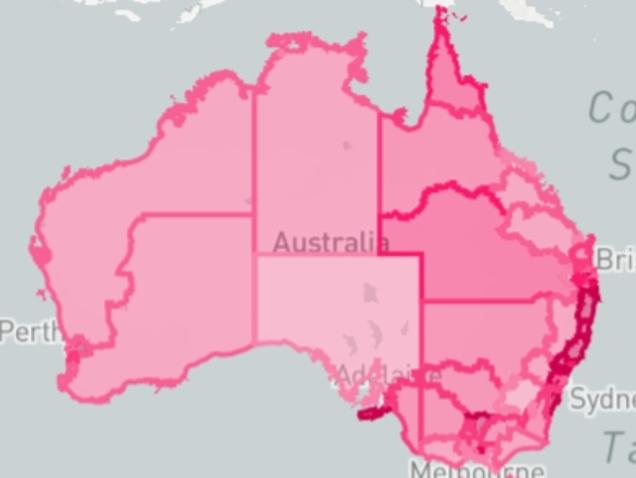

Here is your card guide for house prices and unit around the next five years per state.

Sydney

It is no secret that Sydney is the most exensive real estate market in Australia and if current trends have something to do, it is unlikely to change in the expected future.

Proptrack analysis presents that the average housing price could increase in the 61 percent tumbo in the next five years, taking the median to $ 2.4 million of $ 1.49 million.

The price increases for the Sydney unit market would be less imposing with an increase of 11 percent, taking the new median of $ 796,000 to $ 880,000.

At the suburb, Sydney, and Greater Australia, could welcome a new medium registration in Bellevue Hill.

Sydney’s housing prices are the most successful in the nation and, according to the new modeling, that is not willing to change in the short term.

Prices in the Harborside suburb increased by 50 percent in the last five years, which means that the average ticket price for a house could rise to $ 13.5 million by 2030.

“Sydney is the least affordable real estate market of the nation. It has been basically true every year … with only a letter of exception when Tasmania eclipsed its duration the pandemic,” Moore said.

“Given the challenges of delivering homes in Sydney, and the fact that it is a city of high income, it is not surprising that the house is as expensive as it is. And you know, they are not exactly good news for Sydney housing buyers.

“As for Bellevue Hill, it is a slightly special case. It is a very extent suburb in general and … if that type of growth continues is a very different question of the growth we have seen in the last five years. Place to buy.”

Read the full story here and find your suburb in our search interactive.

Adelaide

There are many reasons to fall in love with Adelaide, but for property buyers, the affordability of the house has the main driving factor in the last five years.

In fact, local and interstate demand has so large that housing prices has increased by 75 percent from 2020 and 64 percent for units.

It means that if prices continue if they had the leg during the last five years, housing prices could increase to a new median of $ 1,474 million by 2030 and $ 938,000 for units.

“Adelaide has been a great beneficiary of the pandemic … by giving people a greater option about the place where they want to live and how they want to live,” said Moore.

“One of the things we saw the duration of the pandemia was that people put much more value to have an additional room so they can work from home and have a little more space.

“Places like Elizabeth and Davoren Park, those northern suburbs have just seen a really strong performance in the last five years, partly because they have been more affordable. And obviously, if they continue to see that type of growth again in the next five years, they would be very unavailable by contrast.”

Read the full story here and find your suburb in our search interactive.

The Adelaide real estate market has been strengthening in the last five years.

Melbourne

It is projected that the suburbs of Melbourne relatives to lead the position of the city for the growth of the price of housing, with six -digit bonds inclined for housing prices around the next five years.

The boxes of areas that include Lower Plenty, Diamond Creek, Beaconsfield, Romsey and Liene are ready to overcome the blue chip areas such as Toorak within the time frame, according to Protrack estimates.

And although the planned price wires will surely tighten the bags of bags of future housing buyers, the financial impact could be less experienced in other parts of Australia.

While housing prices in the last five years increased in two digits in most capitals, sellers did not reap the same benefits in Greater Melbourne.

According to Proptrack, the average price of a house rose only 17 percent between 2020 and 2025, while unit buyers can only 3 percent more than five years ago.

On the positive side, it means that Melbourne could become the most popular Australia market by 2030, that is, if the prices in the last five years are repeated, with the median of a house that jumps in just $ 146000 (from $ 855,000 to $ 11 million).

In just five years, Melbourne’s average housing price could eclipse $ 1 million.

Meanwhile, unit buyers would only have to pay additional $ 15,000 to reach a new median or $ 625,000 by 2030.

“Obviously, Melbourne does not look as strong as other parts of the country in the last five years … (Y) Adelaida is (now) in reality more expectation than in Melbourne,” Moore said.

“It is a quite wild state of things when you consider how much bigger Melbourne is. So, in many ways, Melbourne’s leg grows a little more in recent years.

“There are many reasons for that. Pandemia was obviously part of history, but also part of history is the fact that Melbourne simply builds many more houses than other parts of the country, particularly in western Melbourne.

“And that, you know, the fact that it is more supply has helped keep the housing more affordable.”

Read the full story here and find your suburb in our search interactive.

Hobart

It is projected that two of Hobart’s most affordable suburbs are among the city’s leaders in the growth of household value.

And they will not be alone with a large group to reach a price of $ 1m by 2030.

The Ferry and Rokeby dodged the greatest five -year growth change, increasing by 84 and 85 percent.

The projected strikers, this would make Dodges Ferry move from $ 685,000 for a typical house at $ 1,268 million. And Rokeby would change from $ 630,000 to $ 1,157 million.

Of the analyzed areas, only Sandy Bay has an average value of 2025 exceeding $ 1 million.

If the five -year growth projection became fruity, this figure would shoot 17 suburbs.

Read the full story here and find your suburb in our search interactive.

Hobart is the silent winner of Australia.

Brisbane

The price of a typical house of Queensland could increase by almost $ 700,000 to a call of $ 1.53 million by 2030 if the extraordinary growth of the last five years were continuously.

Proptrack data show that housing prices increased by 68 percent between 2020 and 2025, while unit prices experienced an increase of 53 percent, reaching a new median or $ 642,000.

At the suburb, the most pronounced jumps are inclined to regional and exterior subway areas such as Logan, Wide Bay and Central Queensland.

“Queensland has obviously been one of the great beneficiaries in the last five years. A lot of interstate migration has been seen, pardoned by Nueva Wales del Sur and Victoria,” said Moore. “Queensland has always been a destiny that people moved … but it was a particularly true duration of pandemic, and that has only seen an incredible growth in housing prices in everything basically in Queensland, but specifically regional Queensland.”

Read the full story here and find your suburb in our search interactive.

Investors love Queensland, but they will continue to love the State in five years when the typical house could cost buyers about $ 1.53 million.

Darwin

Housing prices in territory are expected to increase up to 107 percent by 2030 if the rise of pandemic prices will be replicated.

The Muirhead House market is expected to be the best performance, with a 107 percent growth in five years and the average price of housing from $ 730,000 to $ 1,512 million, according to trends from the pandemic boom.

Meanwhile, Dundee Beach would probably see the average cost of a house reached $ 564,000, 66 percent more than the current median or $ 340,000.

In third place is the Millner unit market, with the average sale price that seeks to shoot 64 percent by 2030, from $ 333,000 to $ 543,000.

Completing the first five are the Coconut Grove unit market, planned that it will increase 62 percent to $ 595,000, and the NightCliff house market, 61 percent more to $ 1,609 million.

In Regional NT, the first place, the tasks of Katherine East with the average cost of the house is expected to grow 52 percent by 2030, from $ 330,000 to $ 501,000.

Read the full story here and find your suburb in our search interactive.

The prices of NT housing could increase to 107 percent if housing prices continue as they have increased during the last five years.