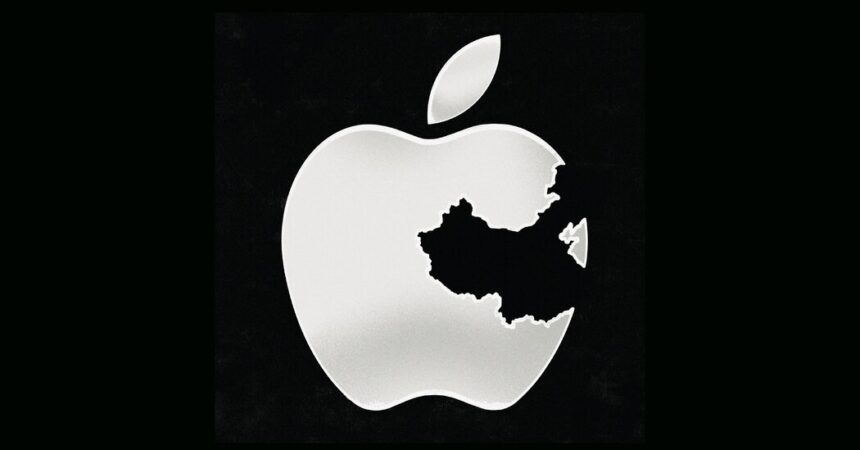

Several years before Donald J. Trump entered politics, Apple and his partners built massive factories in China to gather iPhones. Trump first campaigned for president promising his supporters who would force Apple to make those products in the United States.

Almost a decade later, Little has changed. Instead of bringing its manufacture home, Apple changed some production from China to India, Vietnam and Thailand. Almost nothing is done in the United States, and it is estimated that 80 percent or iPhones are still made in China.

Despite the years of pressure, Apple’s business is still so dependent on China that the technological giant cannot operate without it. It moves through the Trump administration to change Apple’s behavior risk damaging the most valuable company that is quoted in the world’s stock market. And any serious effort to transfer Apple’s production to the United States, if that is possible, would require a titanic effort for both the company and the federal government.

In the four days after President Trump announced taxes on Chinese exports or 145 percent last month, Apple lost $ 770 billion in market capitalization. He recovered some of those losses after Mr. Trump Cool Consumer Electronics Fabricaters in China a temporary respite.

On Thursday, Apple reported $ 24.78 billion in quarterly profits, an increase of 4.8 percent compared to the year a year ago, as a result of strong sales and services sales and a new lower price iPhone, which the company introduced in February. China was the only region in which sales in the quarter did not increase.

An Apple spokesman refused to make available to this article the company’s executives for this article. Duration a call with Wall Street analysts on Thursday, Tim Cook, executive director of the company, said Apple had more than 9000 suppliers in the United States and planned to open a factory in Houston to make artificial intelligence servers.

David Yoffie, a professor at the Harvard Business School who has written case studies on Apple, said the scrutiny was justified because “they are the most at risk company in a complete breakdown from the United States and China.”

Gene Munster, a managing partner of Deepwater Asset Management, who invests in emerging technology companies, estimates that a complete breakdown between the United States and China would reduce Apple’s value by half or more. It would fall into a company of $ 1.6 billion from a company of $ 3.2 billion because a third of its sales are linked to the products made in China, even if it changes some production to a counter. And the value could fall to $ 1.2 billion if it also lost its sales to Chinese customers, as its rival Samsung did after a dispute between the governments of South Korea and China. Beijing has already discouraged iPhone purchases by government employees.

A great drop in the value of Apple Ondular would through the stock market. The company represents approximately 6 percent of the S&P 500 index. That average for each dollar invested in the background, approximately 6 cents go to Apple shares. Investors, and most owners 401 (K) would see that participation cut in half.

Apple’s roots in China are deep. Decades ago, the company worked with Beijing to establish manufacturing in China without creating a joint company with a Chinese company, as required by many US companies. Then it perfects the art of assembling low cost devices in China and selling products to the country’s growing middle class. The combination has won more than 80 percent of global smartphone gains and generated $ 67 billion in Chinese annual sales.

Approximately in time, the company’s ties with China have strengthened. Today, not only does my iPhones in China, but its Chinese suppliers also assemble pieces for devices made in India and manufacture components and airpods in Vietnam.

Apple’s agency in China has caused its supply chain to be a kind of Rorschach test for the Trump administration, which wants to bring more electronic products to the United States. Apple has more power than any other electronics company to meet the objective of the administration. It makes it smartphones than any other person and spends more money on components than rivals, giving it a great influence on where their suppliers operate.

The Trump administration wants Apple to begin this process. In April’s television interview, the secretary of Commerce, Howard Lutnick, said that “the army of millions and millions of human beings screwing small and small screws to make iphones, that kind of thing will reach the United States.”

But pressing Apple to leave China could be counterproductive. The new tariffs could force Apple to raise iPhone prices or accept smaller gains of smartphones. Samsung phones, which are made in Vietnam and are not subject to Chinese tariffs, could be cheaper compared. Apple could become less competitive at home, a red line that Trump rarely wants to cross.

Apple has resisted doing iPhones and other devices in the United States because the company’s operations team has determined that it would be impossible, said two family people with the analysis that spoke about anonymity. A decade ago, I had a bad experience of obtaining screws and finding reliable workers to assemble a Mac computer in Texas.

In China, Apple suppliers can gather 200,000 people. They work in factories supervised by thousands of engineers with years of manufacturing experience. Most live in bedrooms near the iPhone plant, where screens and other components move the assembly lines longer than a football field.

Upon discovering that many experienced employees and engineers would be impossible in most American cities, said Wayne Lam, a Techinsight analyst, a market research firm. He said Apple would need to develop more automated robots processes to compensate for the closest population in the United States.

Mr. Lam estimates that if Apple established operations in the United States, it would need to charge $ 2,000 for an iPhone, of approximately $ 1,000 now, to maintain its currentent gains. The price could fall to $ 1,500 in future years as the company reduced the costs of training employees and making components.

“In the short term, it is not economically feasible,” Lam said. He added that it also made little sense to relocate the production of a device that was almost 20 years old and could be interrupted by a new device that realized consumers.

Apple has shown the will to move its supply chain when there are incentives. In 2017, it was a process to do iPhones in India because the country had high taxes on imports that would have caused prices to increase to a point where Apple could not have claimed a portion of the fastest growing smartphone market for the world.

Today, Apple about 20 percent of its iPhones sold worldwide in India. It also makes some components there, including the metal frame. But it is based on Chinese companies to gather screens and other complex parts.

Matthew Moore, who spent nine years as Manufacturing Design Manager in Apple, said India had another advantage that the United States did not have: “Engineers, everywhere.”

To attract Apple and Electronics companies to the United States, believes Moore, the Trump administration will need to invest in education for science, technology, engineering and mathematics. He also thinks that the country should encourage loans for new manufacturing facilities, as it does for housing with Fannie Mae and Freddie Mac.

Last month, Apple bought a temporary break. Cook, who personally donated $ 1 million to the inauguration of Mr. Trump, pressed the Trump administration for the exemption he gave to the iPhones and other electronic products of the 145 percent tax on Chinese exports. However, it is temporary. The administration has said that it plans to issue more specific tariffs in technological products.

Without government investments, Apple and smaller manufacturers will continue doing things in China because it has an excess of equipment and engineers, said Moore, who started Cruz, a company that manufactures hardware products such as mixers.

“I don’t think the ship has sailed, but it is absurd to think that in four years we are going to do iPhones here,” said Moore. “I would take 10 years.”